24 September, 2024

24 September, 2024

Amidst the ongoing evolution of renewable energy sources, biomass briquettes have emerged as a critical component, offering environmentally sustainable alternatives to traditional fuels. Recent trends observed over the last several months underscore the dynamic nature of India's biomass briquette market. These developments highlight significant shifts in pricing dynamics, fluctuating patterns in supply and demand, and evolving sentiments within the industry. This evolution reflects a growing recognition of biomass briquettes' potential to address energy needs while reducing environmental impact, shaping the future landscape of renewable energy in India.

Factors that affect the prices of biomass briquettes:

The prices of biomass briquettes are influenced by a variety of factors. Biomass briquette prices are affected by the availability and seasonality of feedstock, type of feedstock, raw material costs, manufacturing expenses, market demand, and logistics.

- Availability and Seasonality Biomass availability fluctuates with agricultural cycles and regional variations, impacting local prices based on seasonal abundance or scarcity.

- Feedstock Type

The type of biomass used (such as agricultural residues) affects prices due to differences in collection, transportation, and processing costs.

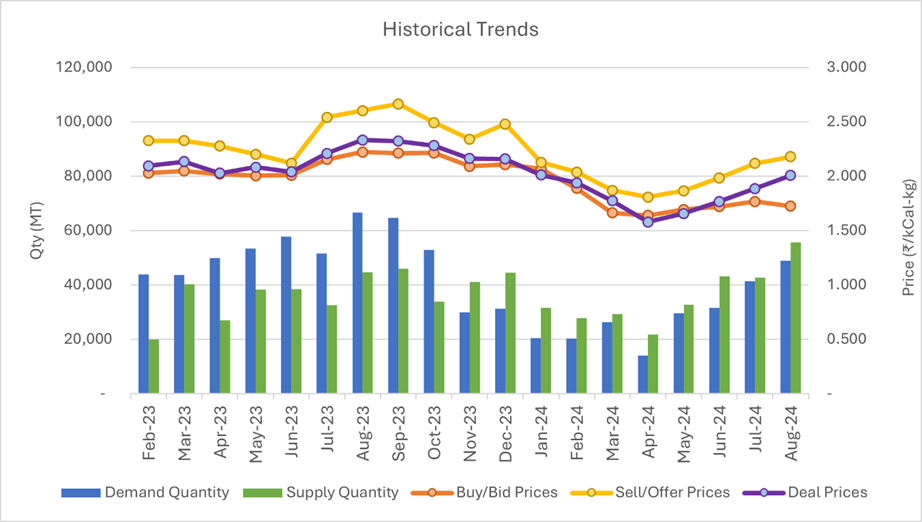

This chart shows the pan-India trend on the BiofuelCircle platform, for weighted average delivered prices of Biomass Briquettes, converted to Rs per Kcal-kg over the past months, along with the availability & demand from our subscribers. Weighted average is calculated using quantity sought/ offered/ deals done, averaging over a month. Buy/Bid prices (orange line) are expectations of Buyers (delivered basis). Sell/ Offer prices (yellow line) are based on responses and sales published by Sellers (again delivered basis). And finally, the Deal prices (purple line) are for deals concluded after platform-based negotiations between Buyers & Sellers. Demand (blue bars) is the total Buy quantity for the month, and Supply (green bars) is the total quantity Offered by Sellers for that month.

This chart shows the pan-India trend on the BiofuelCircle platform, for weighted average delivered prices of Biomass Briquettes, converted to Rs per Kcal-kg over the past months, along with the availability & demand from our subscribers. Weighted average is calculated using quantity sought/ offered/ deals done, averaging over a month. Buy/Bid prices (orange line) are expectations of Buyers (delivered basis). Sell/ Offer prices (yellow line) are based on responses and sales published by Sellers (again delivered basis). And finally, the Deal prices (purple line) are for deals concluded after platform-based negotiations between Buyers & Sellers. Demand (blue bars) is the total Buy quantity for the month, and Supply (green bars) is the total quantity Offered by Sellers for that month.

- Raw Material Costs

The cost of raw materials (like agricultural residues) directly impacts briquette prices, influenced by availability and processing requirements.

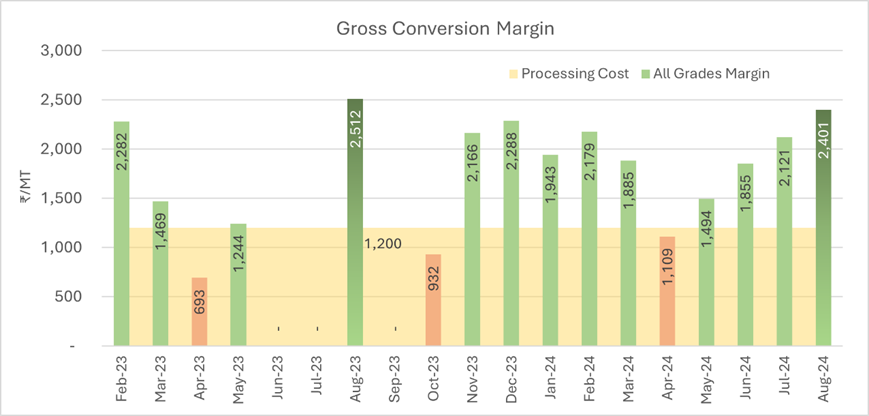

This chart shows the pan-India trend on the BiofuelCircle platform of the difference between the weighted average ex factory price of Briquettes and weighted average delivered prices of Raw Biomass, converted to Rs per Kcal-kg over the past months.To assess the inherent value of briquettes, we have compared the delivered price of raw biomass with the ex-factory price of briquettes. Raw biomass prices have also been adjusted for expected shrinkage across various inputs. The difference represents the GCM (Gross Conversion Margin), which includes the processor’s cost of conversion, inventory holding cost, and profit margin.

In the months of monsoon, the availability of biomass for standard briquettes goes down, and the majority of manufacturers witness a drop in their stocks.

This chart shows the pan-India trend on the BiofuelCircle platform of the difference between the weighted average ex factory price of Briquettes and weighted average delivered prices of Raw Biomass, converted to Rs per Kcal-kg over the past months.To assess the inherent value of briquettes, we have compared the delivered price of raw biomass with the ex-factory price of briquettes. Raw biomass prices have also been adjusted for expected shrinkage across various inputs. The difference represents the GCM (Gross Conversion Margin), which includes the processor’s cost of conversion, inventory holding cost, and profit margin.

In the months of monsoon, the availability of biomass for standard briquettes goes down, and the majority of manufacturers witness a drop in their stocks. - Manufacturing Process Expenses related to briquette production, including machinery, labor, energy, and overheads, contribute to the final market price.

- Market Demand Consumer demand for biomass briquettes as an alternative fuel source influences prices, reflecting broader energy trends and environmental considerations.

- Transportation Costs

Costs incurred in transporting raw materials to production facilities and finished briquettes to end-users affect regional pricing variations and competitiveness.Coal Vs Briquette Prices

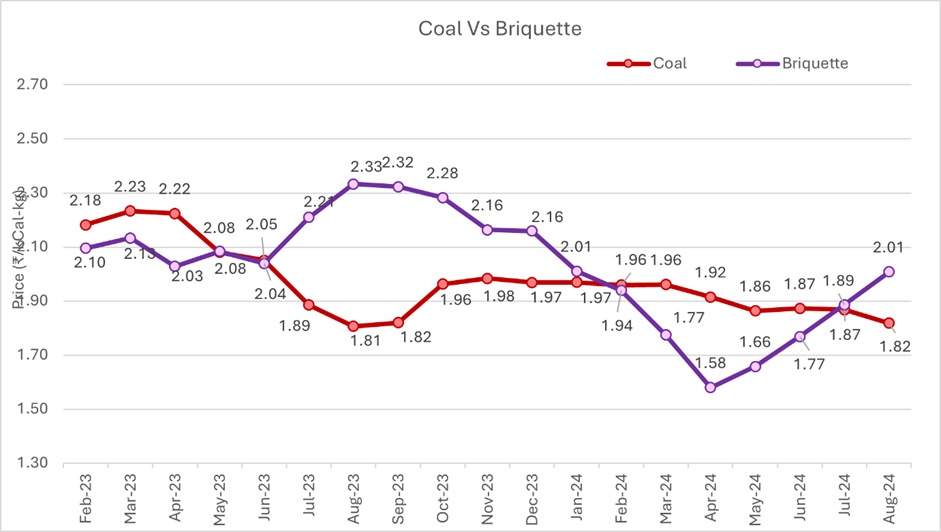

The chart below compares the weighted average delivered prices of Biomass Briquettes to those of imported coal (GCV 3400 GAR). We call the difference between these prices the ‘spread.’ Coal prices in this chart (maroon line) are sourced from market publications, for Indonesian-origin coal (3400 GAR), imported at Kandla and delivered on average 300 km inland. Briquette prices (purple line) are based on deals done on the platform. Both are converted to GCV basis, for meaningful comparison.Coal prices and availability directly influence biomass briquette prices due to their competition as alternative fuels. When coal prices rise, industries often shift to briquettes, increasing demand and driving up prices. Conversely, when coal prices fall or domestic coal production rises, as seen during the monsoon, demand for briquettes may decrease, leading to lower prices. This indicates how fluctuations in coal supply and pricing impact the market dynamics of biomass briquettes.How can one anticipate price fluctuations in biomass briquettes?

Anticipating price fluctuations in biomass briquettes involves a comprehensive approach integrating market analysis, supply and demand dynamics, economic indicators, weather patterns, regulatory impacts, technological advancements, global market trends, and statistical tools. Effective anticipation requires monitoring current market trends, understanding historical price behaviors, and staying informed about factors influencing supply chains, such as raw material availability, production capacities, transportation logistics, and regulatory shifts.

The demand and supply is usually expected to fluctuate during the months between June and September. On the other hand, high demand for biomass briquettes is observed during the season of monsoon.

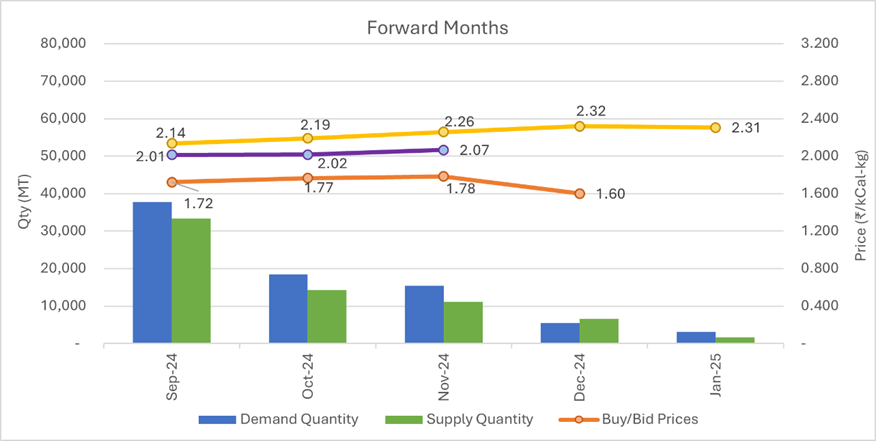

BiofuelCircle platform data allows you to look at prices for the forward months and what trends are they showcasing. Are deals for future delivery being done closer to the Sellers’ prices or buyer’s prices? In the coming months, is the demand and availability nearly balanced?

The chart below compares the weighted average delivered prices of Biomass Briquettes to those of imported coal (GCV 3400 GAR). We call the difference between these prices the ‘spread.’ Coal prices in this chart (maroon line) are sourced from market publications, for Indonesian-origin coal (3400 GAR), imported at Kandla and delivered on average 300 km inland. Briquette prices (purple line) are based on deals done on the platform. Both are converted to GCV basis, for meaningful comparison.Coal prices and availability directly influence biomass briquette prices due to their competition as alternative fuels. When coal prices rise, industries often shift to briquettes, increasing demand and driving up prices. Conversely, when coal prices fall or domestic coal production rises, as seen during the monsoon, demand for briquettes may decrease, leading to lower prices. This indicates how fluctuations in coal supply and pricing impact the market dynamics of biomass briquettes.How can one anticipate price fluctuations in biomass briquettes?

Anticipating price fluctuations in biomass briquettes involves a comprehensive approach integrating market analysis, supply and demand dynamics, economic indicators, weather patterns, regulatory impacts, technological advancements, global market trends, and statistical tools. Effective anticipation requires monitoring current market trends, understanding historical price behaviors, and staying informed about factors influencing supply chains, such as raw material availability, production capacities, transportation logistics, and regulatory shifts.

The demand and supply is usually expected to fluctuate during the months between June and September. On the other hand, high demand for biomass briquettes is observed during the season of monsoon.

BiofuelCircle platform data allows you to look at prices for the forward months and what trends are they showcasing. Are deals for future delivery being done closer to the Sellers’ prices or buyer’s prices? In the coming months, is the demand and availability nearly balanced?

In conclusion, the analysis of biomass briquette market trends underscores its resilience and adaptability in the face of economic fluctuations and environmental imperatives. As the industry continues to evolve, informed decision-making and proactive strategies will be pivotal in driving sustainable growth and meeting the energy needs of a dynamic market landscape.

To know more subscribe to our newsletter - Click Here

In conclusion, the analysis of biomass briquette market trends underscores its resilience and adaptability in the face of economic fluctuations and environmental imperatives. As the industry continues to evolve, informed decision-making and proactive strategies will be pivotal in driving sustainable growth and meeting the energy needs of a dynamic market landscape.

To know more subscribe to our newsletter - Click Here

4195 Views 0 Comments

25 February, 2026

25 February, 2026

Comments